March is National Credit Education Month, so take the opportunity to educate yourself and your loved ones on how credit so they can reach their financial goals.

If you’re thinking about buying a house or refinancing an existing mortgage, you’re in the right place for some good information.

We all know paying our bills on time helps with our credit; still, even when you have every intention of being responsible with credit, some situations can throw you off course and damage your score. For this reason, you must be proactive and take steps to protect yourself from running into credit issues.

Here are a few useful tips to educate you a bit on credit and how it affects your real estate goals:

- No credit is often just as bad as poor credit to a lender. If you have no credit history, start to build it wisely.

- Pay your debts and bills on time to improve your score and build access to credit.

- Check your credit annually to check for errors that may exclude you from future loans.

- Don’t apply for too many new credit cards or co-sign on another line.

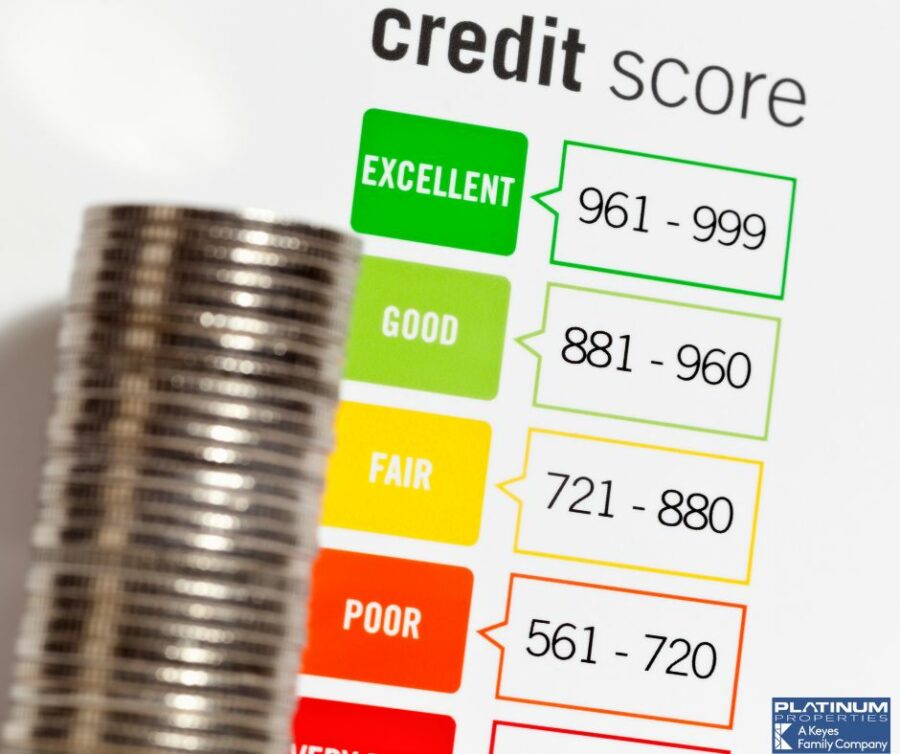

- Your credit report and credit score are two different things. A credit report is a statement that has information about your credit activity and current credit. Your credit scores are calculated based on the information in your credit report.

- A key component of your credit score is how much you currently owe on each account compared to its original loan amount or credit limit.

If you are shopping for a mortgage, knowing one of your credit scores can help you find out the range of mortgage rates you can expect. The type of credit score you need depends on what type of mortgage loan you’re seeking. Although there are options for people will lower credit, most lenders are hesitant to deal with anyone carrying less than 650-700 on their report.

With my wide range of professional resources, I can help get you into the hands of a trusted financial advisor and mortgage lender to get you going in the right direction to achieve your goals. I look forward to helping you!